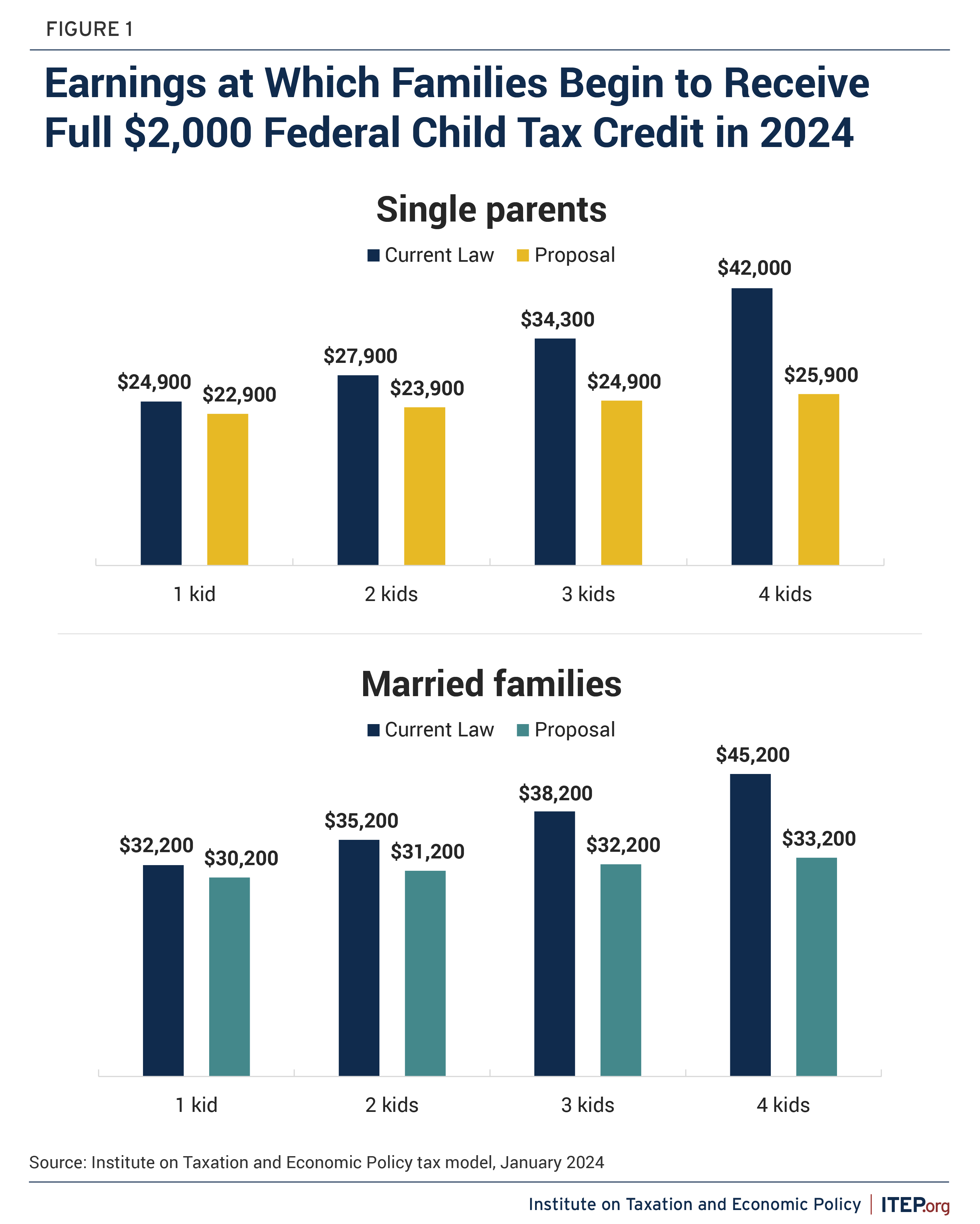

Child Tax Credit Change 2024 – The changes for 2023 are focused on providing more money and increased access to the child tax credit for lower income families. Marr said the changes address a complex formula that currently prevents . Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. .

Child Tax Credit Change 2024

Source : itep.org

US Child Tax Credit Changes 2024: What are the changes and What’s

Source : www.incometaxgujarat.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

EV tax credits 2024: VERIFY Fact Sheet | verifythis.com

Source : www.verifythis.com

The $7,500 EV tax credit will see big changes in 2024. What to

Source : www.npr.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

EV tax credit changes take effect for 2024 | The Hill

Source : thehill.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

2023 2024 Child Tax Credit: What Will You Receive? | SmartAsset

Source : smartasset.com

Child Tax Credit Change 2024 Expanding the Child Tax Credit Would Help Nearly 60 Million Kids : The $78 billion bipartisan tax package includes temporary child tax credit changes that could affect millions of families filing 2023 taxes. If the legislation is enacted, eligible families could see . Sen. Bill Cassidy is advocating for a change to the $600 IRS reporting requirement be included in the child tax credit and business tax bill. .