The Benefits Of Filling Out The 2024 W-4 Form Early – A 1099 form is used to report income that isn’t directly earned through an employer. Because there are many different ways to make money outside of a traditional job, there are several types of 1099 . A Form W-4 is a tax document that employees fill out when they begin a new job The IRS recently released an updated version of Form W-4 for 2024, which can be used to adjust withholdings .

The Benefits Of Filling Out The 2024 W-4 Form Early

Source : www.nerdwallet.com

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

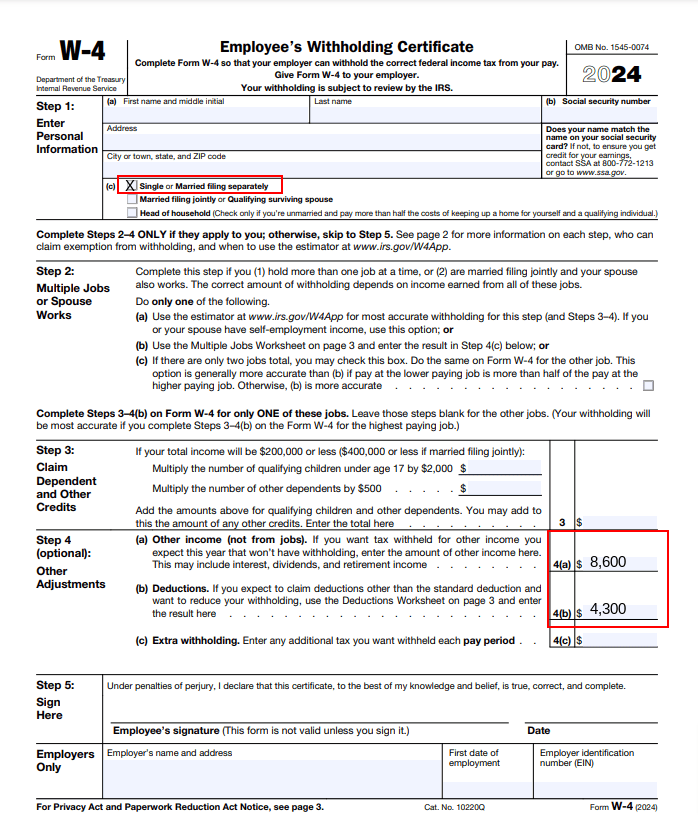

Employee’s Withholding Certificate

Source : www.irs.gov

How to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.com

2024 Form W 4P

Source : www.irs.gov

2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.com

W 4 Form: Extra Withholding, Exemptions, and More | Kiplinger

Source : www.kiplinger.com

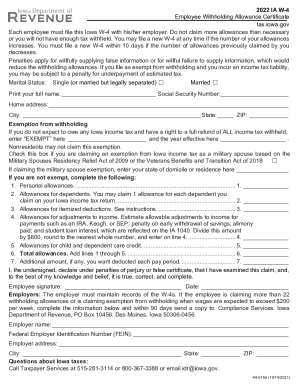

IA DoR W 4 2022 2024 Fill and Sign Printable Template Online

Source : www.uslegalforms.com

The Benefits Of Filling Out The 2024 W-4 Form Early W 4: Guide to the 2024 Tax Withholding Form NerdWallet: Many or all of the products here are from our partners that compensate us. It’s how we make money. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. . That said, early filing isn’t right for everyone. The IRS recently advised those who received a stimulus or rebate payment from their state to wait until the government works out if and how that .